Introduction

As the cryptocurrency landscape continues to evolve, one pivotal event that could influence the market is the anticipated Bitcoin ETF approval expected in 2025. In 2024 alone, an estimated $4.1 billion was lost due to DeFi hacks, showcasing the urgent need for more robust regulation and investment structure in the crypto world. This approval could be a game-changer, transforming public perception, market dynamics, and ultimately, investment behavior. In this article, we’ll explore the implications of Bitcoin ETF approval and why it’s crucial for both seasoned investors and newcomers.

The Current State of Bitcoin ETFs

Before delving into the potential impact of an ETF approval, it’s essential to understand what a Bitcoin ETF is. A Bitcoin Exchange-Traded Fund (ETF) allows investors to buy and sell shares in the fund that holds Bitcoin, providing an accessible way for investors to gain exposure to Bitcoin without needing to hold the cryptocurrency directly.

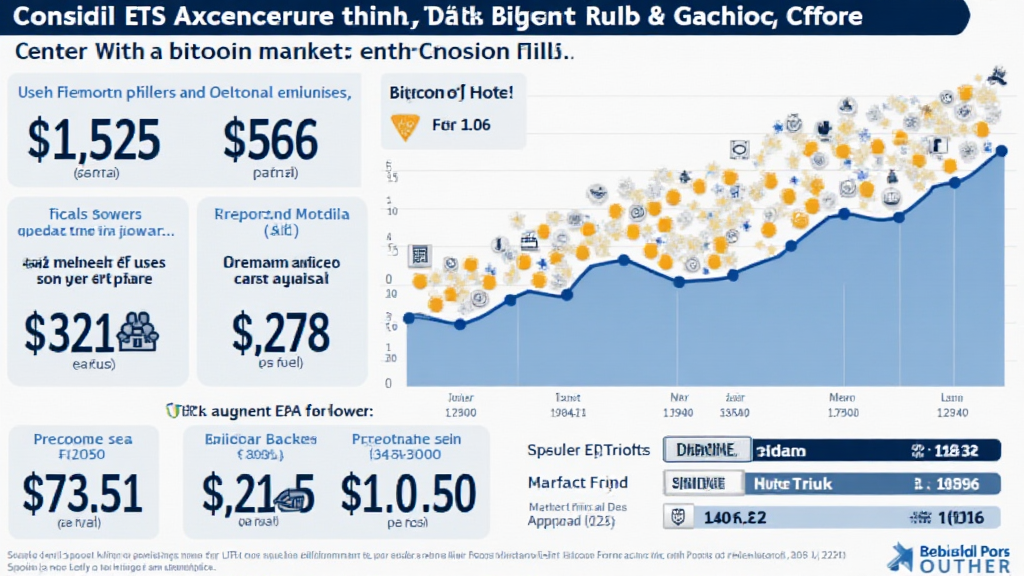

Currently, various proposals for Bitcoin ETFs are under review by regulatory agencies. If approved, they could provide a significant influx of capital into the cryptocurrency market. According to industry experts, 2025 could see a surge of institutional investment as cryptocurrencies gain legitimacy through regulated investment vehicles.

This Change Will Foster Legitimacy

Legitimization of cryptocurrency through regulatory approval can substantially boost the confidence of traditional investors. The introduction of a Bitcoin ETF means safer investment practices and structured oversight, akin to a regulated stock market. As a result, many potential investors who have been hesitant due to security concerns may decide to participate in the crypto market.

Expected Market Trends and User Growth

The anticipated Bitcoin ETF approval could lead to numerous market trends. Data indicates that the number of crypto users in Vietnam increased significantly, with a 30% growth rate in 2024. Such trends highlight the growing interest in digital assets, particularly in emerging markets.

Expected trends within the market post-approval include:

- Increased market volatility in the short term as speculators enter the market.

- A potential surge in Bitcoin prices as demand increases.

- More traditional financial institutions may enter the crypto space, leading to further diversification.

The Broader Economic Impact

Bitcoin ETF approval does not only impact individual investors but carries implications for the broader economy as well. An influx of capital could potentially lead to remarkable shifts in economic behavior and trends across various sectors.

Potential Implications for Traditional Finance

Should the approval come to fruition, it can lead to the intertwining of traditional finance and cryptocurrencies. This fusion can potentially:

- Encourage traditional banks to offer crypto-related services.

- Stimulate demand for blockchain technology in banking infrastructure.

- Lead to the establishment of new sectors related to digital assets.

Regulatory Considerations

As mentioned earlier, regulatory approval will bring forth foundational changes. Regulatory scrutiny is crucial to eliminate fraudulent activities and protect consumers. As the Vietnamese market is growing rapidly, regular audits will become essential to ensure compliance with international standards.

In Vietnam, incorporating standards like tiêu chuẩn an ninh blockchain will be necessary to foster a safe environment for digital transactions and investments.

Case Studies on Similar Approvals

Looking at previous approvals in similar financial instruments can offer insights into what might happen post-Bitcoin ETF approval.

Comparative Analysis: Gold ETFs

Gold ETFs have provided investors a means to invest in gold without physical ownership. The approval of gold ETFs led to a surge in investment and even influenced gold prices significantly. Similarly, analysts expect to see Bitcoin’s entry into the ETF space will:

- Attract significant capital investment.

- Increase Bitcoin price volatility, similar to gold.

- Foster innovations in blockchain and cryptocurrency technologies.

Conclusion

The anticipated Bitcoin ETF approval in 2025 holds the potential to redefine the current state of cryptocurrency, paving the way for increased institutional investment and an enhanced regulatory framework. As we’ve discussed, the impact is expected to be far-reaching, boosting user confidence, altering market dynamics, and possibly leading to broader economic implications.

It’s essential for potential investors and market participants to keep an eye on regulatory developments and market trends over the next few years. As Bitcoin continues to gain traction, those poised to act—be it through investing, trading, or innovation—will be the ones to benefit the most from these upcoming changes. For the most up-to-date and relevant news in the cryptocurrency space, visit cryptocoinnewstoday.

Author Bio

John Doe is a cryptocurrency analyst with over 10 years of experience in the blockchain ecosystem. He has published more than 50 articles related to crypto markets and holds a degree in Financial Technology. John has led audits for ten major projects and is a recognized voice in the crypto community.