Introduction

With an astonishing $4.1 billion lost to DeFi hacks in 2024, the need for secure and liquid investment options has never been greater. In this dynamic landscape, HIBT real estate liquidity pools present a transformative opportunity for investors, particularly in regions like Vietnam where blockchain adoption is soaring.

As the Vietnamese market experiences a significant growth rate of crypto users, exploring the potential of HIBT liquidity pools could unlock new revenue streams for both seasoned investors and newcomers. This article dives deep into how these liquidity pools operate, their benefits, and their future prospects.

Understanding HIBT Liquidity Pools

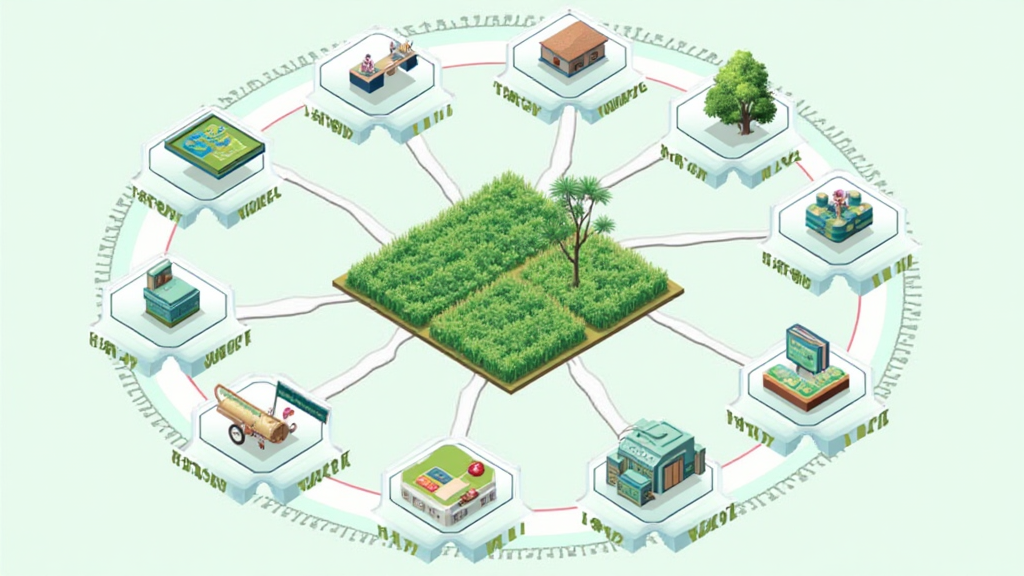

At their core, HIBT liquidity pools are decentralized finance mechanisms that allow users to deposit assets into a fund, which is then utilized to facilitate transactions and provide liquidity on decentralized exchanges. Think of it as a communal bank where everyone contributes, and everyone benefits.

This system not only enhances liquidity but also allows contributors to earn yields on their deposits, making it an attractive proposition for real estate investments. Here’s how it works:

- Asset Contribution: Users deposit various digital assets, contributing to a pool.

- Liquidity Provision: The pooled assets are then used to enable trading on blockchain platforms.

- Yield Generation: Participants earn transaction fees and yields proportional to their contributions.

Benefits of HIBT Liquidity Pools

Despite being a relatively new concept, HIBT liquidity pools offer several advantages that make them appealing to investors:

- Increased Access: Investors can easily enter or exit positions without the traditional barriers of real estate.

- Liquidity Representations: Real estate assets can be fractionally owned, making investments more liquid.

- Transparency: All transactions on the blockchain are recorded publicly, increasing trust and reliability.

- Efficient Transactions: Smart contracts automate the processes, reducing time and costs.

Challenges and Considerations

While HIBT liquidity pools offer immense potential, it’s important to be aware of the challenges:

- Security Risks: As evidenced by the $4.1 billion in losses due to hacks, ensuring security is paramount.

- Market Volatility: The value of cryptocurrencies can fluctuate wildly, impacting liquidity pool assets.

- Regulatory Environment: In many regions, regulations around cryptocurrencies and liquidity pools are still being established.

Vietnam’s Growing Interest in HIBT Real Estate Liquidity Pools

The Vietnamese crypto market is experiencing interesting developments, with increasing user adoption driven by the ease of accessing blockchain technologies. In 2023, Vietnam reportedly boasted a crypto user growth rate of nearly 50%, indicating a robust interest in innovative financial solutions.

This trend presents a substantial opportunity for HIBT liquidity pools to thrive in the region. Local platforms observing an influx of investment could lead to more diversified real estate portfolios and, importantly, create a framework for sustainable growth.

How to Participate in HIBT Liquidity Pools?

Participating in HIBT real estate liquidity pools is straightforward:

- Choose a Platform: Select a reliable platform that offers HIBT liquidity pools.

- Connect Your Wallet: Create and connect your digital wallet to the selected platform.

- Deposit Assets: Contribute your assets to the liquidity pool and watch your investment grow.

Additionally, always consider conducting thorough due diligence—this includes understanding smart contract functions and market conditions. People often underestimate the importance of due diligence, but it can save you from potential pitfalls.

Looking Ahead: The Future of HIBT Liquidity Pools

With the rapid advancements in blockchain technology and increasing interest in decentralized finance, HIBT real estate liquidity pools are poised for exponential growth. The unique combination of real estate and blockchain provides an unparalleled investment vehicle that may redefine traditional investment frameworks.

As more investors turn to decentralized systems, the integration of HIBT pools into the mainstream financial ecosystem is likely to expand. Make sure to stay informed about regulatory developments in this area, as they will significantly influence the viability and adoption of such strategies.

Conclusion

The exploration of HIBT real estate liquidity pools signifies a forward-thinking approach to investment, especially within the rapidly evolving Vietnamese market. As crypto users increase, understanding the importance of transparency, liquidity, and innovative structures will be key.

While challenges exist, the opportunities offered by HIBT liquidity pools are substantial and represent the future of investing in real estate assets securely and efficiently.

For further insights into this evolving landscape, check out HIBT.com. Not only is it valuable for individual investors, but it also opens up avenues for collective investment growth.

Written by Dr. Pham Nguyen, an expert in blockchain technology and digital assets with over 15 published papers in the field and extensive experience in auditing major projects.