Introduction: Understanding Bitcoin Halving

With $4.1 billion lost to DeFi hacks in 2024, understanding Bitcoin halving historical data is more critical than ever. Bitcoin halving, an event that occurs approximately every four years, drastically affects the supply and economic model of the world’s first cryptocurrency. Amidst the volatile crypto landscape, this crucial event provides valuable insights into price patterns, investor behavior, and future market dynamics.

This article delves into the historical data of Bitcoin halving events, analyzing their impact on the market, providing actionable insights for investors in Vietnam, and guiding you through what to expect in the upcoming halving in 2024.

What is Bitcoin Halving and Why Does it Matter?

Bitcoin halving refers to the event that reduces the reward miners receive for validating transactions by half. Initially set at 50 BTC per block, this reward halved to 25 BTC in 2012, then to 12.5 BTC in 2016, and currently stands at 6.25 BTC after the 2020 halving. The next event will occur in 2024, where it will further drop to 3.125 BTC.

The significance of Bitcoin halving includes:

- Supply Scarcity: As the reward decreases, the rate at which new bitcoins enter circulation slows down, creating scarcity.

- Market Sentiment: Historically, halving events have led to bullish market sentiment and price increases.

- Mining Incentives: Halving affects miners and could lead to increased mining efficiency and competition.

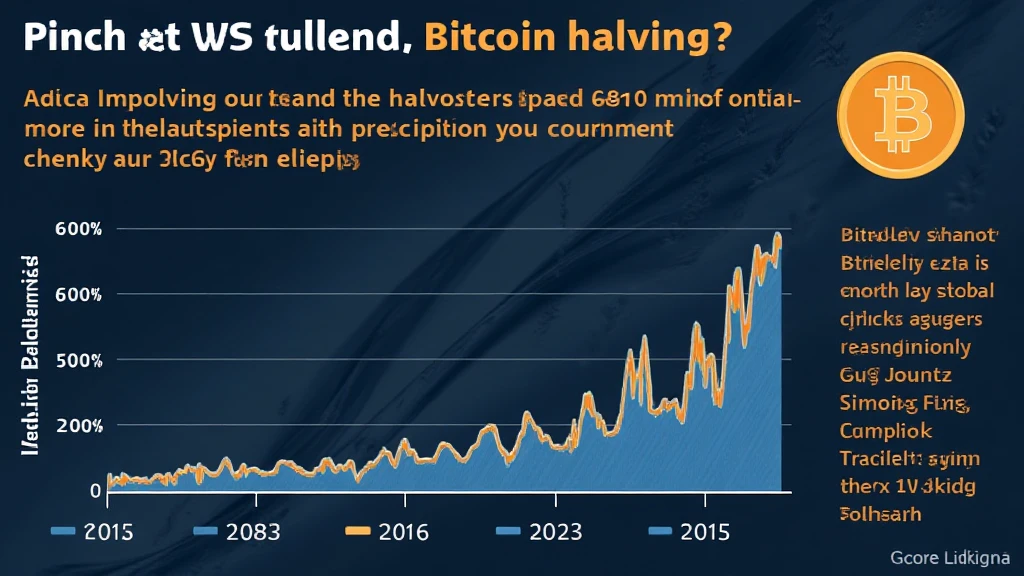

A Look at Historical Halving Data

To understand the phenomenon of Bitcoin halving, let’s analyze the historical data surrounding the past events.

1. First Halving (2012)

The first halving occurred on November 28, 2012. At this time, Bitcoin was trading around $12.31. The aftermath saw a significant boost in price, peaking at $1,163 in December 2013.

| Event | Date | Price Before Halving | Price Peak After Halving |

|---|---|---|---|

| 1st Halving | November 28, 2012 | $12.31 | $1,163 |

2. Second Halving (2016)

The second halving took place on July 9, 2016. Bitcoin was valued at approximately $657 before the event, climbing to almost $20,000 by December 2017. This was a notable period as it introduced Bitcoin to mainstream media and a surge of new investors.

| Event | Date | Price Before Halving | Price Peak After Halving |

|---|---|---|---|

| 2nd Halving | July 9, 2016 | $657 | $19,783 |

3. Third Halving (2020)

The most recent halving happened on May 11, 2020. Bitcoin’s price was around $8,500, and it soared past $64,000 by April 2021. This period also saw an influx of institutional investment, revolutionizing Bitcoin’s reputation.

| Event | Date | Price Before Halving | Price Peak After Halving |

|---|---|---|---|

| 3rd Halving | May 11, 2020 | $8,500 | $64,000 |

The Future: What to Expect from the 2024 Halving

The 2024 Bitcoin halving is anticipated to occur in April. Current trends suggest that as we approach the halving, investor sentiment will build steadily. To understand this environment better, let’s consider the following factors impacting the upcoming halving:

- Global Market Trends: Increased institutional involvement and traditional finance integration will likely affect Bitcoin’s behavior leading up to the halving.

- Mining Technology Advances: Enhanced mining technologies could impact miners’ profitability post-halving, influencing market supply.

- Regulatory Perspectives: Geographical regulations, especially in Vietnam, will ultimately shape the adoption curve for Bitcoin.

Vietnam: The Emerging Market

Vietnam’s cryptocurrency market has seen rapid growth, boasting an increase of 300% in user engagement in the past year. This surge creates a dynamic environment for Bitcoin and its upcoming halving.

With more citizens becoming aware of Bitcoin’s potential, the country serves as a barometer for broader adoption across Asia. Using local resources and understanding user behavior will be crucial.

Moreover, concepts such as tiêu chuẩn an ninh blockchain (blockchain security standards) have become increasingly relevant. As the crypto landscape evolves, so do the measures needed to secure digital assets.

Conclusion: Key Takeaways on Bitcoin Halving Historical Data

While Bitcoin halving historical data shows a pattern of price increases following each event, it is essential to approach these trends with a prudent perspective. Factors such as global market dynamics, technological advances, and local regulations—especially in countries like Vietnam—will play significant roles in shaping Bitcoin’s future. Investors should stay informed and adapt to the ever-evolving landscape.

By understanding the intricacies of Bitcoin halving, you can better prepare for the possible repercussions in your investment strategy. Remember, this is not financial advice—consult local regulators for any investment decisions.

For more insights on cryptocurrency trends and secure practices, keep following cryptocoinnewstoday.

Author: Dr. Nguyen Van A

A blockchain expert with over 10 publications on cryptocurrency economics, Dr. A has conducted audits on several notable projects in the crypto space. His insights into the evolving Bitcoin narrative promise readers a richer understanding of this digital asset.