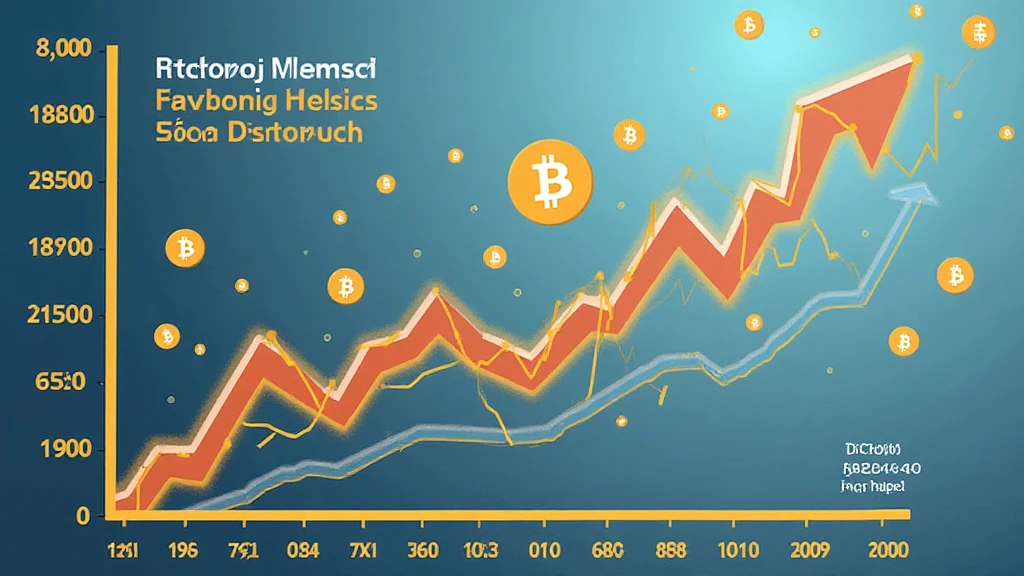

Understanding Bitcoin Halving Market Forecasts

With the crypto space seeing a staggering increase of investment in recent years, especially in Bitcoin, it’s crucial to understand key events that impact market dynamics. One of the most anticipated occurrences within the Bitcoin ecosystem is the Bitcoin halving. Historical data indicates that these halving events could significantly influence Bitcoin prices and, consequently, the market forecasts surrounding it. In this article, we dive into the intricacies of Bitcoin halving, market predictions, and potential implications for investors.

What is Bitcoin Halving?

Bitcoin halving is a crucial mechanism embedded in the Bitcoin protocol. Every four years, the reward for mining Bitcoin blocks is halved, meaning miners receive 50% fewer bitcoins for verifying transactions. This event is pivotal as it directly influences Bitcoin’s supply dynamics. As the supply of new bitcoins entering circulation decreases, historical trends suggest that the decrease can lead to increases in demand, thus affecting the price positively.

Historical Perspectives on Bitcoin Halving Events

- First Halving – November 2012: Reward reduced from 50 BTC to 25 BTC.

- Second Halving – July 2016: Reward reduced from 25 BTC to 12.5 BTC.

- Third Halving – May 2020: Reward reduced from 12.5 BTC to 6.25 BTC.

Each halving has historically been followed by substantial price rallies, leading to increased public interest and investment in Bitcoin.

Why Do Bitcoin Halvings Matter?

Understanding the importance of halving events is vital for gauging market sentiments. In the lead-up to each halving, traders often speculate about price increases, causing a surge in market activity. Interestingly, evidence from previous halvings shows that the period following each halving has usually resulted in significant price increases.

Current Market Sentiment

As we approach the next Bitcoin halving in 2024, market analysts and investors are once again gearing up to predict potential price movements. In Vietnam, for instance, the cryptocurrency surge has witnessed a staggering growth rate of 130% in user adoption over the past year, indicating rising interest in Bitcoin among local investors. Reports suggest that these local trends echo the historical precedents set by past halvings, with anticipatory buying habits emerging as the halving date draws near.

Market Forecasts Based on Bitcoin Halving

Forecasting the market in light of upcoming Bitcoin halvings can be complex due to various influencing factors including macroeconomic conditions, regulatory environments, and advancements in technology. Nevertheless, we can derive several insights based on past behaviors:

1. Price Projections

Many analysts project that Bitcoin prices may see fluctuations exceeding $100,000 by 2025 following this year’s halving. These projections arise from historical trends showcasing price explosions tied closely to halving events.

2. Mining Dynamics

Post-halving, miners experience a direct impact on profitability due to the reduced mining rewards. In Texas, for example, several mining operations have begun strategizing to enhance efficiency in expectation of the subsequent halving. This location has become a mining hotspot, partly due to favorable regulations aimed at lowering operational costs.

3. Increased Investments

Halvings draw a lot of speculative investments. The so-called ‘halving cycle’ includes increased institutional interest post-halving events, a trend evident in 2020 as major institutions began to pile into Bitcoin purchases.

Market observers from across Asia predict similar outcomes post-2024 halving, especially with younger generations increasingly seeing cryptocurrency as a viable investment vehicle.

Implications for Investors

Investing in Bitcoin around halving events can be rewarding, but it carries risks. Investors must do thorough research and be aware of the market’s volatility.

1. Long-Term Planning

Investors must consider long-term strategies instead of mere speculation. Just like a bank vault designed to protect assets, maintaining a diversified investment portfolio serves as a safeguard against market unpredictability.

2. Research and Development

New technologies and trends, such as the rise of decentralized finance (DeFi), present potential opportunities. For instance, understanding how to audit smart contracts is crucial for ensuring secure investments within the DeFi space.

3. Local Market Understanding

Familiarity with local regulations and audience behavior, particularly for emerging markets like Vietnam, is essential for maximizing investment turns.

Conclusion

In summary, Bitcoin halving represents a pivotal moment within the cryptocurrency ecosystem, shaping market trends and forecasts. As we approach another halving in 2024, readiness and informed decision-making will be paramount for investors looking to maximize their returns. Anticipation for market shifts related to Bitcoin halving can encourage prudent investment strategies.

As always, it’s important to do your own research and consult with financial advisors to tailor strategies to your individual needs. The information provided in this article is not financial advice. As the crypto landscape continues to evolve, keeping abreast of developments ensures you remain informed and engaged in the future of digital currencies.

For more insights into cryptocurrency trends and predictions, visit cryptocoinnewstoday.

Written by: Dr. Nguyễn Văn An, a renowned blockchain expert with over 30 published papers and the lead auditor for multiple high-profile blockchain projects.