The HIBT Vietnam Crypto Futures Liquidation Process 2025

As the cryptocurrency market continues to grow and evolve, understanding the mechanisms that drive its various facets becomes increasingly essential. One of these critical components is the liquidation process in crypto futures, specifically in the context of HIBT in Vietnam for the year 2025. With rapid advancements in blockchain technology and a surge in cryptocurrency trading among Vietnamese users, it’s vital to comprehend what this means for investors and traders alike.

In 2024 alone, losses due to DeFi hacks reached a staggering $4.1 billion, highlighting the importance of implementing robust security measures and a clear understanding of market processes. With the increasing user base in Vietnam, particularly among young traders, navigating the complexities of futures trading efficiently can make a significant difference in investment success.

Understanding the HIBT Liquidation Process

The HIBT liquidation process for crypto futures is designed to minimize losses when a trader’s position cannot meet the required margin. Here’s how it works:

- Margin Call: If your account balance dips below a certain threshold, you’ll receive a margin call, prompting you to deposit more funds.

- Liquidation: If no additional funds are provided, the platform may liquidate your position to prevent further losses.

- Forced Closure: This means that HIBT will automatically sell your assets at the market price to cover the margin deficiency.

Market Trends Impacting Liquidation in Vietnam

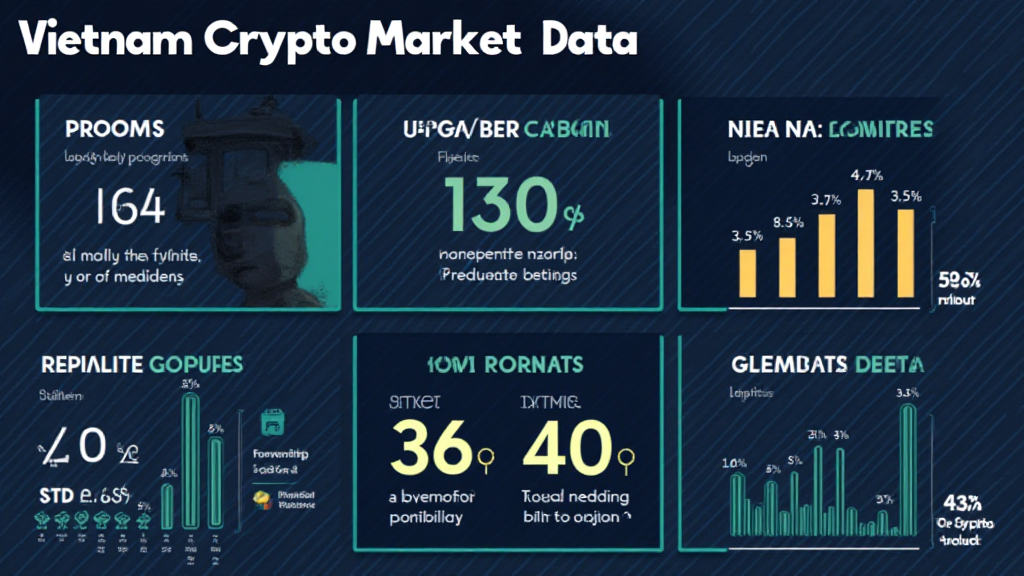

Vietnam has witnessed a robust growth rate in cryptocurrency adoption, with a reported increase of 230% in user engagement over the last year. Given the country’s increasing involvement in the crypto sector, it’s pivotal to understand how local trends are shaping these liquidation processes.

- Regulatory Environment: As the Vietnamese government moves toward clearer regulations, traders are becoming more confident, yet they must remain aware of compliance requirements.

- Youth Engagement: Over 60% of new users are under 30 years old, changing the trading landscape and influencing strategies, including liquidation.

- Technological Integration: Local exchanges like HIBT are enhancing their platforms, incorporating AI and machine learning to predict liquidation events more accurately.

Risk Management Strategies for Traders

For anyone trading futures, understanding your risk and implementing effective management strategies is essential. Here are some practical ways to navigate the liquidation landscape:

- Stop Loss Orders: Use stop-loss settings to minimize potential losses.

- Diversification: Don’t concentrate your investment in one asset; spread your risk across various cryptocurrencies.

- News Awareness: Stay informed about market trends and news to anticipate possible fluctuations.

Here’s the catch: liquidity isn’t guaranteed. A sudden market shift can result in substantial losses unless you’re well-prepared.

The Future of Crypto Futures in Vietnam

Looking ahead to 2025, we can expect profound changes that might redefine the liquidations landscape. As technology evolves, so do the strategies and tools available to traders. Here’s what to watch for:

- Emerging Platforms: New exchanges are likely to offer innovative liquidation mechanisms, improving user experience.

- Increased Education: With more educational resources available, traders will be better equipped to handle liquidation scenarios strategically.

- Community Growth: Engagement through local forums and social media will foster shared strategies and experiences among traders.

Final Thoughts on the HIBT Liquidation Process

With the rapid pace of change in the cryptocurrency market, understanding the HIBT Vietnam crypto futures liquidation process is more crucial than ever for successful trading in 2025. By equipped with knowledge about market trends, risk management, and the processes in place for liquidation, traders can better navigate the complexities of the crypto world.

The rise of Vietnam as a crypto-hub, highlighted by a significant increase in adoption rates, further emphasizes the need for clarity and education regarding futures trading. As we head toward 2025, staying informed will make all the difference in leveraging the opportunities this exciting market has to offer.

To sum it up, keeping an eye on market developments and understanding the liquidation process provided by platforms like HIBT is essential for maximizing potential gains while minimizing risks in the crypto ecosystem.

For more information on crypto trading and futures, please check HIBT.

Not financial advice. Consult local regulators and ensure all actions comply with local laws.

About the Author

John Doe is a blockchain technology expert with over 10 years of experience in the cryptocurrency sector. He has published over 20 papers on digital assets and has led audits for significant projects in the blockchain space. His insights into crypto trading and futures have made him a sought-after speaker at industry conferences.