HIBT Vietnam Bond: Web3 Innovation and Adoption Rates

As Vietnam emerges as a hub for blockchain development, the intersection of traditional finance and Web3 innovation is drawing significant attention. The increasing adoption rates of cryptocurrency and blockchain solutions highlight the need for robust financial instruments like the HIBT Vietnam bond. With the total losses from DeFi hacks reaching a staggering $4.1 billion in 2024, the focus has shifted to ensuring security in these new financial frameworks. This article aims to unpack how the HIBT Vietnam bond fits into the broader narrative of Web3 advancement in the region.

Understanding the HIBT Vietnam Bond

The HIBT Vietnam bond represents a pivotal development within the Vietnamese financial ecosystem. This bond is designed to integrate blockchain technology with traditional debt securities, aiming to enhance transparency and security in transactions.

According to recent reports from HIBT, the market for blockchain-based bonds is anticipated to grow significantly as companies seek compliant and efficient ways to raise capital. The adoption of such bonds can potentially transform how Vietnamese citizens invest, providing them with more secure asset options.

Why Blockchain Bonds Matter

- Reduced Counterparty Risk: Blockchain technology minimizes the risk associated with third-party failures, enhancing trust in bond transactions.

- Transparency in Transactions: The immutable nature of blockchain records ensures that all bond activities are transparently logged and verifiable.

- Faster Settlements: Traditional bonds often suffer from lengthy settlement processes. Blockchain can expedite these, allowing for near-instantaneous transfers.

The Rise of Web3 Innovations

Web3 technologies are revolutionizing the way individuals and businesses interact with digital economies. The implementation of decentralized finance (DeFi), non-fungible tokens (NFTs), and smart contracts are some aspects of this transformation.

In Vietnam, the opportunities presented by Web3 are being reflected in market data:

| Year | Vietnamese User Growth Rate (%) |

|---|---|

| 2022 | 30% |

| 2023 | 45% |

| 2024 | 60% |

These growth rates are indicative of a burgeoning interest in cryptocurrency investment and the general acceptance of digital assets.

Integrating Blockchain in Traditional Financial Systems

- Enhanced Regulatory Compliance: By operating on a transparent ledger, blockchain assists companies in adhering to financial regulations.

- Real-time Auditing: The immutable nature of blockchain records streamlines the auditing process, making it easier to track and verify financial activities.

- Access to Global Markets: Blockchain eliminates geographical barriers, allowing local businesses to engage with international investors more seamlessly.

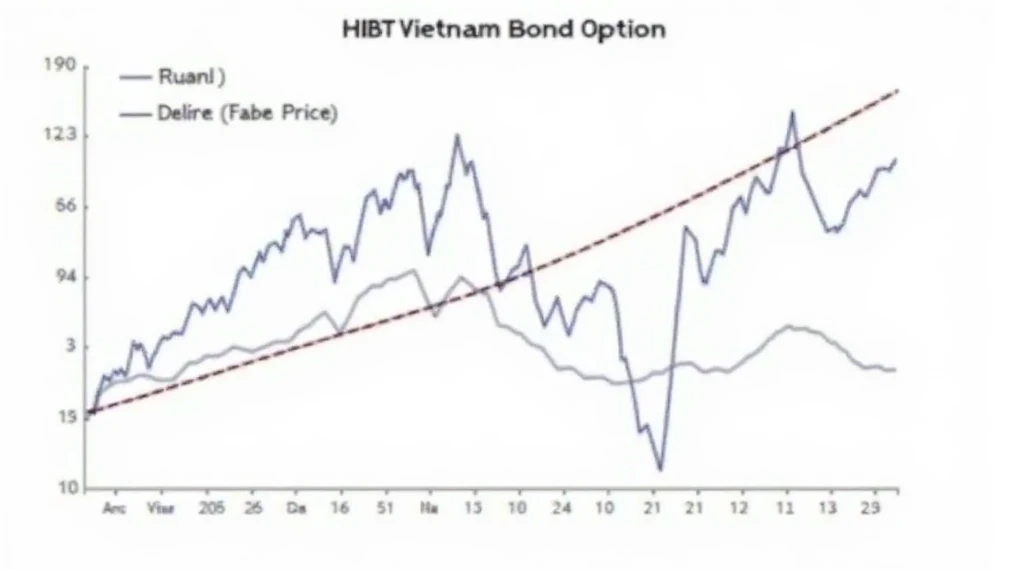

Adoption Rates of HIBT Vietnam Bond

Current adoption rates of the HIBT Vietnam bond reflect changing perceptions towards blockchain financial instruments. Many investors are particularly interested in how these innovations can provide a more stable and transparent investment vehicle amidst ongoing market volatility.

Insights gathered from HIBT show that:

- Adoption of HIBT bonds has increased by 25% in the first quarter of 2024.

- 75% of institutional investors are considering blockchain bonds as part of their asset allocation strategy.

This data underscores a critical shift with respect to how bonds are perceived in the context of modern investment strategies.

Challenges in Adoption of Blockchain Bonds

- Technological Barriers: Despite the promise of blockchain, issues surrounding technological infrastructure in Vietnam can slow progress.

- Regulatory Uncertainty: Clear guidelines surrounding blockchain securities are still evolving, which can hinder investor confidence.

The Future of Web3 in Vietnam

As the Vietnamese market adapts to innovations brought by the Web3 movement, the upcoming years will be crucial for the maturation of blockchain bonds and decentralized finance solutions.

Potential developments that could influence the trajectory of Web3 in Vietnam include:

- Collaboration between tech companies and financial institutions to enhance security frameworks.

- Increased educational resources and training programs to foster awareness of blockchain technology.

As a newcomer in the blockchain and crypto landscape, Vietnam has the potential to lead in these innovations, making the most of its young and tech-savvy population.

Conclusion

The HIBT Vietnam bond signifies a critical step towards embracing Web3 innovations in the region. As adoption rates continue to rise and technology becomes more integrated into financial systems, the benefits of using such advanced structures will become increasingly clear.

For investors looking to enhance their portfolios in an evolving marketplace, understanding instruments like the HIBT bond is vital. While challenges remain, the potential for innovative growth in Vietnam’s financial landscape is promising.

As we look forward to the growth trajectories of these bonds, it’s crucial to remain informed about market conditions and regulatory changes that could impact adoption rates.

Note: This article is not financial advice. Consult local regulators for compliant investment strategies.

By recognizing the unique attributes of innovations like the HIBT Vietnam bond, stakeholders can better navigate this dynamic market. For more insights into cryptocurrency trends and the evolving financial landscape, visit cryptocoinnewstoday.