Tracking HIBT Vietnamese Retail Bond Demand: Insights from Cryptocoinnewstoday

With the emergence of cryptocurrencies reshaping financial landscapes worldwide, including Vietnam, how are retail bond demands evolving? In 2023, Vietnam saw a burgeoning growth rate of 125% in its digital asset users. This significant trend highlights an underlying force driving the demand for retail bonds like HIBT.

Understanding these shifts is crucial for investors and stakeholders. In this article, we delve into the dynamics of HIBT Vietnamese retail bond demand tracked by Cryptocoinnewstoday comprehensively.

The Evolution of the Vietnamese Bond Market

In Vietnam, the bond market was traditionally dominated by government bonds and corporate bonds. However, with technological advancements and increased accessibility to digital platforms, retail bonds have started becoming popular. As of 2023, Stellar studies reveal that retail bonds accounted for 30% of total bond market transactions, a significant rise from previous years.

What drives this transformation? Let’s break it down further:

- Increased Awareness: Information dissemination through platforms like Cryptocoinnewstoday has led to heightened awareness among retail investors.

- Accessibility: The rise of mobile and online investing platforms enhances easy access for individual investors.

- Trust and Transparency: Emerging blockchain solutions, particularly the concepts of tiêu chuẩn an ninh blockchain, foster a secure environment for bond trading.

Understanding HIBT’s Role

HIBT (Hanoi Investment Bond Trust) specifically epitomizes innovation within the Vietnamese retail bond sector. It helps local investors become accustomed to the dynamics of the bond market while reducing risks involved. This bond’s underlying mechanics emphasize:

- Tokenization: Using blockchain technology to represent bonds digitally, making transactions smoother and quicker.

- Liquidity: Presence in the digital era ensures more liquidity, making it easier for investors to buy or sell assets.

- Compliance: As a regulated instrument, HIBT adheres to all government standards, which builds further trust.

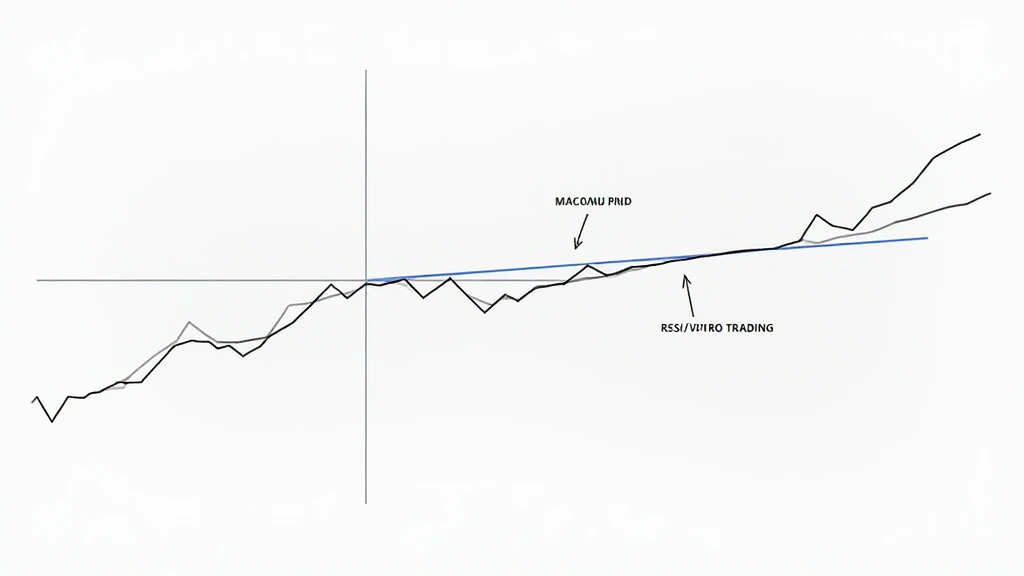

Current Trends in Retail Bond Demand

As per recent insights from Cryptocoinnewstoday, retail bond demands have witnessed notable patterns:

- Increased Participation: The demographic of bond investors is shifting, with younger generations expressing more interest.

- Technological Integration: Tools like smart contracts are increasingly used for automated processes during bond issuance and lifecycle management.

- Educational Initiatives: Various organizations are investing in educating retail investors through seminars and online courses, exemplified by the work done by HIBT.

Data Insights

Understanding the raw numbers can provide a clearer picture:

| Year | Value of Retail Bonds (USD Billion) | Percentage Growth (%) |

|---|---|---|

| 2021 | 1.2 | – |

| 2022 | 1.5 | 25% |

| 2023 | 2.0 | 33% |

Data Source: Hanoi Bond Exchange

Challenges and Opportunities

Underneath this growth lies inherent challenges that need addressing:

- Market Volatility: The evolving market can be unpredictable, with fluctuations determined by global influences.

- Regulatory Measures: Adapting to regulations is a constant effort, especially as new blockchain standards emerge.

Nonetheless, the opportunities are equally significant. The role of HIBT in driving the integration of tiêu chuẩn an ninh blockchain suggests that the future will likely hold robust innovations.

How to Audit Smart Contracts for Retail Bonds

As blockchain technology advances, ensuring the security and functionality of smart contracts associated with bonds becomes increasingly necessary. Here’s a simple guide:

- Framework Selection: Utilize frameworks like Truffle to create environments for development and testing.

- Testing Protocols: Employ rigorous testing protocols to validate all functionalities.

- Regular Audits: Engage with third-party auditors to ensure independent evaluations of contracts.

In 2025, the focus on auditing will be paramount, and understanding how to audit smart contracts will undoubtedly become a necessary skill in the investment ecosystem.

Conclusion: Future of HIBT and Retail Bonds

As we reflect on HIBT Vietnamese retail bond demand tracked by Cryptocoinnewstoday, it becomes evident that the convergence of technology and finance is not a fleeting trend. With a compound growth rate forecast of 40% over the next three years, HIBT stands poised to lead the charge in Vietnam’s financial innovation landscape. For retail investors, engaging with these bonds offers a unique opportunity to navigate the evolving market, especially as security standards rise due to tiêu chuẩn an ninh blockchain. As the financial scene continues to transform, platforms like Cryptocoinnewstoday will remain indispensable in providing insight and guidance.

Note:** Not financial advice. Consult local regulators before investing.

Author: Nguyen Tuan, specializing in financial technology and blockchain auditing. With 15 published papers and having led audits for several well-known projects, he brings a wealth of experience to the conversation on Vietnam’s evolving financial landscape.