Exploring HIBT Government Bond Trading Volumes in Vietnam via Cryptocoinnewstoday

In recent years, Vietnam has seen significant growth in cryptocurrency adoption, mirroring its rising bond trading volumes. As of 2024, reports suggest that digital asset investments, including government bonds, are gaining traction among Vietnamese investors. With around $4.1 billion lost to DeFi hacks in 2024, the urgency for security in trading is emphasized.

This article dives into the intricacies of HIBT government bond trading volumes in Vietnam, highlighting its correlation with the burgeoning cryptocurrency market. We will explore the fundamental aspects of blockchain technology, government bonds, and investment trends, offering readers a comprehensive perspective on the landscape of digital asset trading.

Understanding HIBT and Its Role in Government Bonds

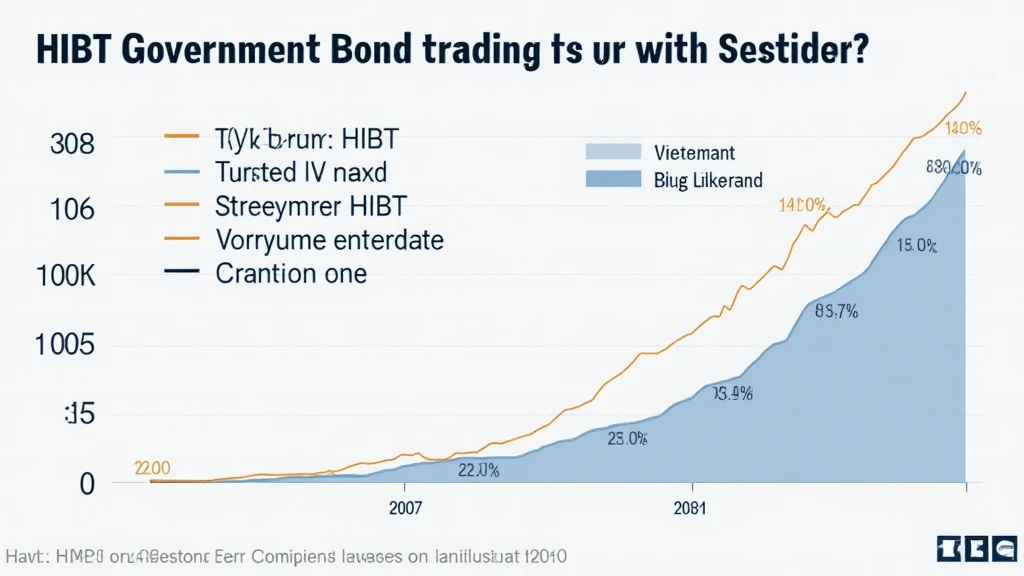

The HIBT, or the High-Integrity Bond Trading system, facilitates the trading of government securities in a robust and secure manner. This system has not only improved the efficiency of bond trading but has also increased the transparency around such transactions.

- Volume Growth: Recent statistics indicate that government bond trading volumes in Vietnam have doubled in just two years.

- Investor Confidence: Vietnamese investors are increasingly drawn to secure and reliable government-backed instruments, especially post-pandemic.

Cryptocurrency Integration into Government Bond Markets

The integration of blockchain technology in bond trading presents a unique opportunity for the financial sector. Leveraging the transparent and immutable nature of blockchain can enhance trust and attract more investments.

For example, using blockchain can streamline the issuance process of government bonds, reducing transaction costs and time involved significantly.

The Mechanics of Trading Government Bonds through Cryptocurrencies

Though the trading volumes of HIBT in Vietnam are impressive, the inclusion of cryptocurrencies adds a layer of complexity. The trading of government bonds via cryptocurrencies can aid in reaching a broader investor base, especially the younger demographic who are more inclined to engage in digital finance.

Scenario: A Day in the Life of a Vietnamese Bond Trader

Consider a Vietnamese investor, Nguyen, who uses a cryptocurrency wallet to buy bonds. Nguyen’s journey from learning how to audit smart contracts to purchasing HIBT government bonds showcases how blockchain technology is becoming a part of traditional finance.

Market Data and Growth Statistics

Vietnam’s cryptocurrency user growth rate has surged by 45% since 2022. According to local financial data, the demand for government bonds has risen by 60% during the same period. This dual increase suggests a potential for cryptocurrency to reshape how bonds are traded.

| Year | Bond Trading Volume (VNĐ) | Crypto Users (%) |

|---|---|---|

| 2022 | 1 trillion | 30% |

| 2023 | 2 trillion | 40% |

| 2024 | 4 trillion | 45% |

Potential Risks and Mitigating Strategies

As with any investment vehicle, trading HIBT government bonds through cryptocurrencies comes with risks. Regulatory environments in Vietnam remain complex, and users must navigate these challenges.

- Market Volatility: Fluctuations in cryptocurrency prices can pose risks for investors transitioning into government bonds.

- Regulatory Compliance: Understanding local laws regarding blockchain technology and cryptocurrency transactions is vital.

Future Trends in HIBT Trading Volumes

The growing interest in blockchain technology and government bonds indicates promising trends for the future of trading in Vietnam. Experts predict a surge in trading volumes, accelerated by innovations in technology and market strategies aimed at increasing participation.

Additionally, HIBT is expected to play a pivotal role in this evolution, influencing investment patterns substantially.

Conclusion

As we explore the landscape of HIBT government bond trading volumes in Vietnam, it is clear that the fusion of blockchain technology and traditional finance is inevitable. The undeniable interest from both traditional investors and the crypto-savvy younger generation paints a solid picture for the future of investments in Vietnam.

In summary, Vietnam presents a fertile ground for innovations in bond trading, with the potential to redefine how securities are viewed in the digital age. As the market grows, maintaining security standards becomes essential, prompting discussions on tiêu chuẩn an ninh blockchain for the safety of investments.

For more insights into cryptocurrency trends and regulations, keep following Cryptocoinnewstoday.

Author: Dr. Lam Hoang (Ph.D. in Financial Technology, published over 15 papers in blockchain finance, and led auditing for the FinTech project in Vietnam).