Introduction

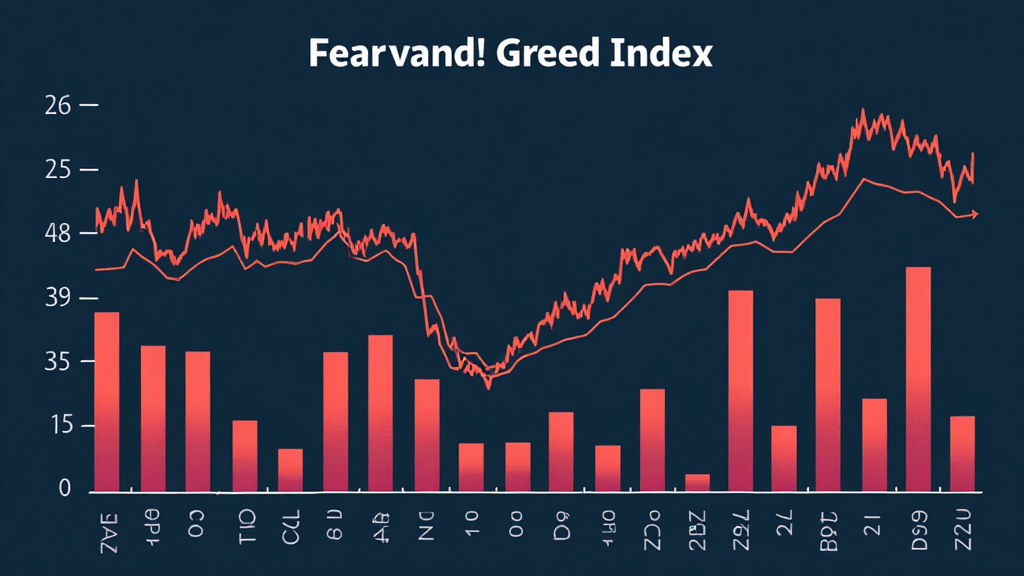

With over 2 million blockchain users in Vietnam in 2024 and an explosive growth outlook, the question arises: how can investors leverage this trend? Many investors lost a staggering $4.1 billion to DeFi hacks last year, underlining the critical need for sound strategies. This article outlines Vietnam digital asset investment strategies tailored for minimizing risks and maximizing returns in 2025.

Understanding the Vietnamese Market Landscape

In recent years, Vietnam has emerged as a prominent player in the digital asset space, spurred on by a highly tech-savvy population and favorable government regulations. According to a report by hibt.com, the average yearly growth rate for blockchain adoption in Vietnam is projected to hit 55%. This explosive growth offers new opportunities for investors.

The Role of Education in Investment

- Building knowledge around blockchain security standards (tiêu chuẩn an ninh blockchain) is crucial.

- Understanding local regulations can mitigate risks.

- Participating in forums and webinars enhances practical knowledge.

Investment Vehicles in Vietnam

Investors can choose from several vehicles when entering the Vietnam digital asset market. Here’s a breakdown:

- Cryptocurrencies: Bitcoin remains the king, but consider altcoins like Ethereum and upcoming plays like Polkadot.

- Tokenized Assets: Real estate or art as digital tokens can enhance liquidity.

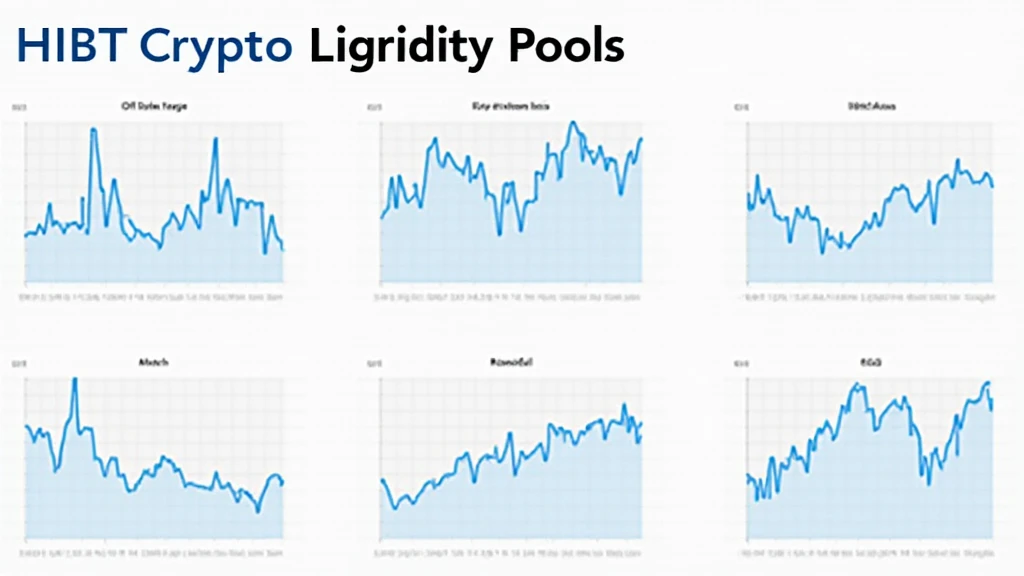

- DeFi Products: Yield farming and lending platforms are gaining traction.

Exploiting Local Trends

Consider these trending Vietnamese digital assets:

- VND-based stablecoins: The adoption of stablecoins pegged to the Vietnamese Dong can provide a hedge against volatility.

- Local NFT Platforms: Growth in digital art and collectibles is expected, driven by Gen Z.

Security Measures and Best Practices

Investing comes with its risks, but there are ways to protect your assets:

- Cold Wallet Storage: Hardware wallets like Ledger Nano X reduce hacks by up to 70%.

- Smart Contract Audits: Ensure that any DeFi protocols or platforms are audited to avoid vulnerabilities.

Decoding Smart Contracts

Understanding how to audit smart contracts is evolving into a necessary skill for investors. Conducting thorough audits ensures that no hidden risks could compromise your investments.

Diving Deeper: Vietnamese Regulations and Compliance

The Vietnamese government has shown a growing interest in regulating the cryptocurrency market, making it imperative for investors to stay informed:

- New tax laws around crypto trading are being discussed.

- Compliance with local regulations is vital for sustaining business operations.

Strategies for Compliance

- Consult local resources frequently to remain compliant with evolving regulations.

- Work with legal experts on financial advisory to navigate the complexities.

Conclusion

2025 presents unique opportunities for those interested in the Vietnam digital asset investment strategies. By leveraging technological advances, investing in education, and remaining compliant, you’ll be well-positioned to succeed. As always, consult local regulators before making any financial commitments. Remember, strategies that combine traditional finance with emerging digital trends will breed the most significant returns.

For more insights, visit cryptocoinnewstoday.