Understanding Vietnam Crypto Market Microstructure: A Comprehensive Guide

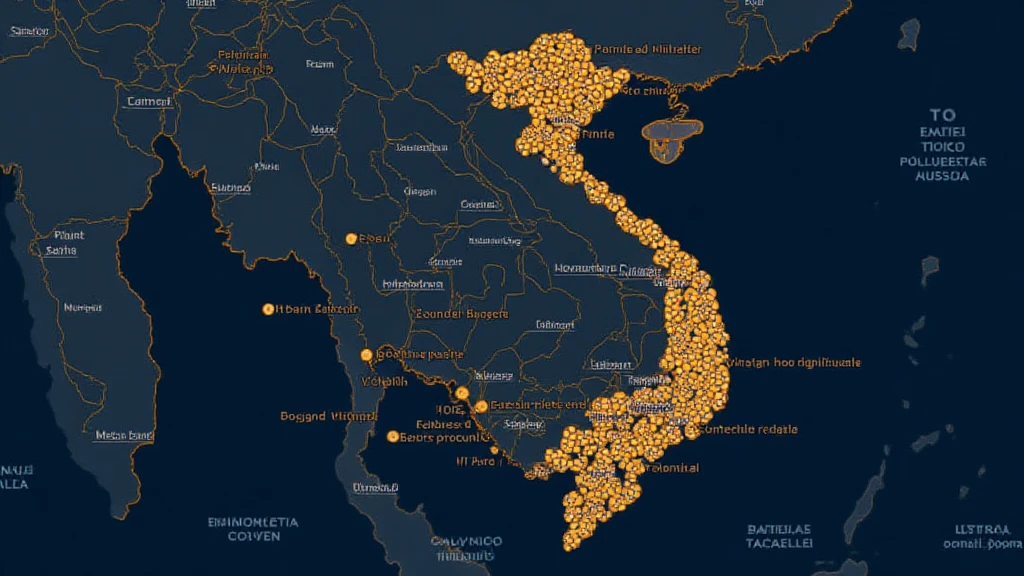

With the Vietnam crypto market burgeoning at a staggering rate, recent reports estimate that the user growth rate stands at over 200% in 2023. This represents a significant leap in interest and investment in cryptocurrencies within the region.

But what does this mean for potential investors and market participants? In this guide, we will delve deep into the microstructure of the Vietnam crypto market, shine a light on crucial aspects like liquidity, trading volumes, and the regulatory environment that shapes this dynamic landscape. Let’s explore the components behind the Vietnam crypto market microstructure and understand how they influence trading decisions.

The Foundations of Vietnam’s Crypto Market Microstructure

At its core, the microstructure of any financial market involves the mechanisms through which assets are traded, the players involved, and the information that drives transactions. In Vietnam, several key components contribute to the current state of the crypto market:

- Exchange Platforms: Several local and international exchanges operate in Vietnam, including Binance and Vietnamese exchanges like Vicuta. These platforms determine liquidity levels and trading fees.

- Liquidity Providers: Many crypto markets rely on liquidity providers to facilitate trade execution. Understanding their role is vital for grasping market dynamics.

- Market Makers: They help maintain price stability by providing buy and sell orders.

Understanding Trading Volume and Its Implications

Trading volume is a crucial indicator of market health. In the Vietnam crypto market:

- The total trading volume has skyrocketed, reflecting growing participation.

- High trading volumes can lead to improved liquidity, which enhances price stability.

- Analyzing trends in trading volume can help investors identify potential market shifts and make informed decisions.

For example: According to hibt.com, the daily trading volume surged to $150 million in late 2023, indicating a vibrant trading environment.

Case Study: A Deep Dive into Local Exchanges

Local exchanges have unique features that cater to the Vietnamese user base, creating a fascinating case study.

- Vicuta: This exchange gained popularity for its user-friendly interface and competitive rates. Its localized approach has facilitated an influx of new users.

- Sàn Remitano: Focuses on peer-to-peer trading, allowing users to transact directly without intermediaries.

The Role of Regulation in the Vietnam Crypto Market

As with any financial market, regulation plays a pivotal role in shaping the landscape. In Vietnam, regulatory efforts are gradually evolving:

- The government has proposed frameworks to regulate crypto exchanges and facilitate legal compliance.

- Ongoing discussions about central bank digital currency (CBDC) hint at the future direction of cryptocurrencies.

However, it is important to note that regulations can impact market dynamics, liquidity, and investor confidence. Naturally, “tiêu chuẩn an ninh blockchain” will become a topic of utmost discussion among regulators and stakeholders.

Challenges Facing the Vietnamese Crypto Market

While the potential for growth is tremendous, significant challenges remain:

- Fraud and Scams: Increased activity also brings higher risks of fraud and scams, creating distrust among investors.

- Market Volatility: Like all crypto markets, Vietnamese exchanges take part in the larger swings seen globally.

Strategies for Navigating the Vietnamese Crypto Market

Investors need robust strategies to mitigate risks and capitalize on opportunities:

- Diversification: Spread investments across different assets to reduce risks.

- Stay Informed: Keep abreast of local regulatory updates and market changes.

- Utilize Tools: Consider utilizing tools like Ledger Nano X for secure transactions.

Future Outlook: Trends to Watch for in Vietnam’s Crypto Market

As we move towards 2025, several trends are emerging that investors should monitor:

- Increased Institutional Investment: Larger investments from institutions may drive acceptance and liquidity.

- Education and Awareness: Growing educational initiatives will prepare investors and facilitate a more secure trading environment.

As mentioned earlier, the user growth rate has proven promising. With anticipated growth projections for the next few years, the local crypto scene might become a hotspot for investors.

Conclusion: Embracing the Future of Vietnam’s Crypto Microstructure

In summary, the microstructure of the Vietnam crypto market is rapidly evolving. As trading volumes increase, regulatory frameworks develop, and awareness expands, opportunities await for discerning investors. Navigating this space will require combined diligence, adaptability, and strategic foresight.

As we continue to observe this landscape, it’s clear: understanding the Vietnam crypto market microstructure will be key to making informed investment decisions moving forward.

For readers keen on further insights, feel free to visit cryptocoinnewstoday. Here’s to a secure and prosperous investing journey!