Introduction: Navigating the Future of Bond Management

With the global financial ecosystem evolving at a staggering pace, the rise of blockchain technology has transformed various sectors, especially in finance. In 2024 alone, it is estimated that over $4.1 billion was lost to DeFi hacks, emphasizing the urgent need for robust financial management solutions. This is where blockchain bond management tools emerge as pivotal players in ensuring security and enhanced operational efficiency in managing bonds.

In Vietnam, the adoption of such tools is gaining traction, paralleling the country’s growing interest in cryptocurrency investments. Elucidating the implications of employing blockchain for bond management in Vietnam could pave the way for improved investment security and compliance with global standards. This article, therefore, will explore the essential features of blockchain bond management tools, their advantages in the Vietnamese market, and the upcoming trends that investors and financial institutions should be aware of.

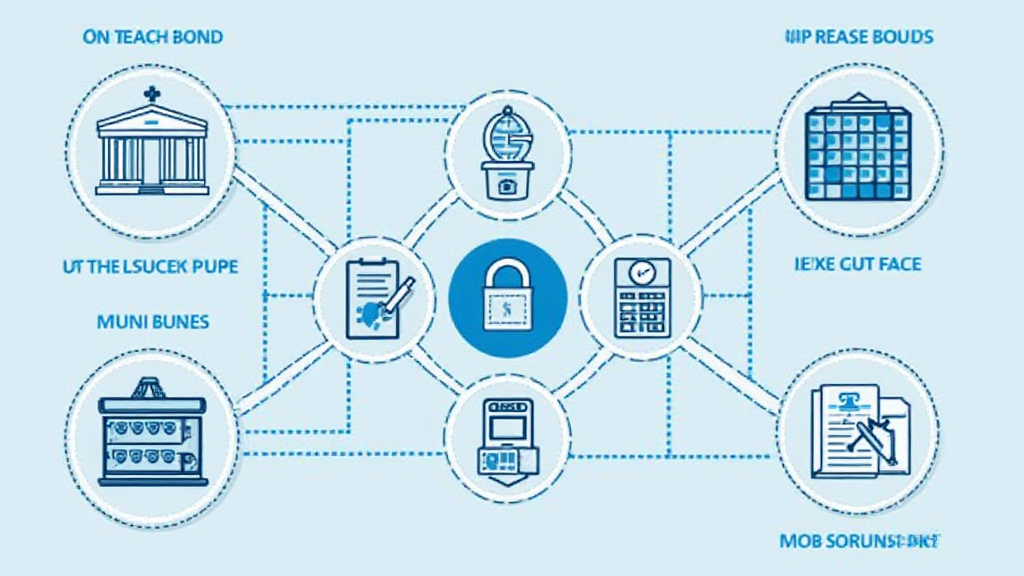

Understanding Blockchain Bond Management Tools

At its core, blockchain technology provides a decentralized ledger that is not only immutable but also transparent. For bond management, this translates into significant benefits:

- Transparency: Each transaction is recorded on the blockchain, making it easier to audit and trace funds.

- Efficiency: Smart contracts automate processes that traditionally require intermediaries, reducing operational costs.

- Security: With advanced cryptographic security protocols, bonds managed through blockchain are less susceptible to fraud.

Key Features of Blockchain Bond Management Tools

1. Smart Contract Integration

Smart contracts automate various aspects of bond issuance and management. Once pre-defined conditions are met, the contract executes actions seamlessly. For instance, when interest payments come due, the smart contract can automatically disburse payments to bondholders without requiring manual intervention.

Here’s the catch: the transparency that smart contracts offer means that all stakeholders can validate transactions, fostering trust. As Vietnam advances into a more digital future, leveraging smart contracts in the bond market can reduce the time and costs associated with bond issuance.

2. Compliance and Reporting Tools

Compliance is crucial in the financial industry. Blockchain bond management tools often come equipped with automated compliance features that adhere to regulatory requirements effectively. For example, tools can automatically generate reports that comply with local law such as tiêu chuẩn an ninh blockchain, enhancing the efficiency and accuracy of reporting.

In Vietnam, as financial legislation becomes more stringent, having a blockchain-based solution will alleviate the burden of compliance, providing transparent reporting accessible by regulatory bodies.

3. Investor and Stakeholder Access

Blockchain enables broader access for various stakeholders involved in bond issuance. Investors can access real-time data on their investments, trade bonds seamlessly, and verify their holdings through an immutable ledger. This level of access is becoming increasingly necessary in the fast-paced investment climate.

As per recent studies, Vietnam’s user growth rate in crypto investments is forecasted to soar by 30% in the next year, which means that the demand for accessible investment tools will continue to increase.

The Vietnamese Market Landscape

Vietnam’s burgeoning economy is witnessing a digital transformation, evident through the increasing adoption of cryptocurrency and blockchain technologies. Here are some relevant statistics to consider:

- Vietnam has one of the highest growth rates in blockchain adoption, with a 28% year-on-year increase.

- Recent surveys indicate that 53% of Vietnamese investors are considering diversifying into digital assets.

Such trends highlight the necessity for blockchain bond management tools in Vietnam as they present a viable solution to address both local and global investment challenges.

Future Outlook and Recommendations

Looking into 2025, the landscape for blockchain bond management in Vietnam is set to evolve uniquely. Here are key trends to watch:

- Increased Integration with Traditional Finance: Financial institutions will explore partnerships with tech companies to offer blockchain-based services, enhancing the credibility of these products.

- Focus on Security: As fraud continues to threaten the crypto space, enhancing security measures in blockchain systems will be paramount.

- Regulatory Advancements: Vietnamese authorities are likely to establish clearer regulations governing cryptocurrency and blockchain transactions, paving the way for mainstream adoption.

For investors and stakeholders, staying updated on these trends will be crucial. Adopting blockchain bond management tools is not just about leveraging technology; it is about ensuring compliance, increasing operational efficiency, and ultimately enhancing security.

Conclusion: Embracing Blockchain in Vietnam’s Financial Future

Blockchain bond management tools are not merely an innovation; they are a necessity for the evolving financial landscape in Vietnam. With increased security, transparency, and efficiency, these tools hold the key to navigating the complexities of bond management in the digital age. As more players enter the market, the onus lies on both investors and institutions to adapt and adopt these emerging technologies promptly.

In summary, as Vietnam forges ahead into a digital future, the integration of blockchain technology in bond management will be paramount. Embracing these innovations today will ensure readiness for the financial challenges of tomorrow. To stay informed on the latest developments in crypto and blockchain, turn to cryptocoindaily!